You may remember the bomb that the government dropped on us back in March: Interest expenses you may deduct from residential rental property will now be limited and the period for the bright-line rule is extended. They’ve taken a few months to suss out the details, and we finally have more information for you.

But first, a quick reminder of why the changes were proposed.

The government believes that by limiting the deductibility of interest, it will make residential property a less attractive investment option. They hope that this would level the playing field for first home buyers, which is why the change is only on residential property, not commercial.

They still want to encourage the supply of new housing because of the housing shortage we’re experiencing, which is why they introduced some exemptions for purchasing new builds as well as for property development.

The bill has not been passed yet, they expect this to be done by early 2022, so technically these may still change. The public will still have the opportunity to give feedback on the proposed bill.

There are two important dates to note:

- 1 October 2021: This is when the new rules came into effect.

- 27 March 2021: Different rules apply depending on whether you bought your property before or after this date.

Let’s look at some of the most important changes.

1. Limitation of Interest Deductions Allowed

There are no major changes from our previous blog. In summary, the following changes came into effect from 1 October 2021:

- If you bought a property after 27 March 2021: No interest can be deducted.

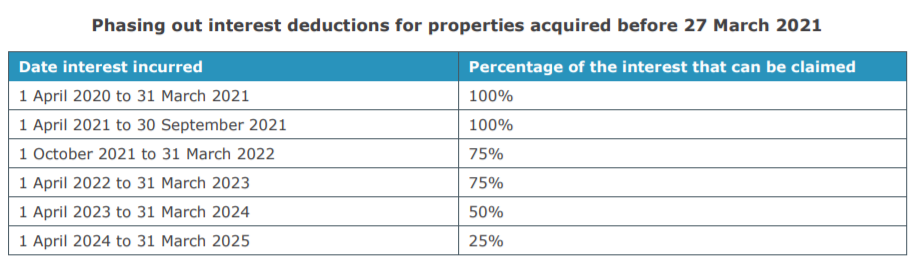

- If you bought a property before 27 March 2021: The interest deductibility will be phased out between 1 October 2021 to 31 March 2025.

Any interest incurred up until 30 September 2021 will be 100% deductible, but going forward a lower percentage will apply until it’s phased out completely. See the table below for these percentages:

IRD estimate that they will generate additional tax revenue on these changes as follows:

- 2022 – $80 million

- 2023 – $200 million

- 2024 – $350 million

- 2025 – $490 million

- 2026 – $650 million

As you can imagine, these changes add a layer of complexity, so if you need any help with working out how much you can and can’t deduct, get in touch with us to help. You can also find more information on IRDs info sheet.

Which Exemptions Are Available?

There are a few exemptions to the rule. These include:

- the main home, even if part of the main home is rented out to a flatmate or boarder

- farmland

- commercial accommodation (hotels, motels, hostels, but not short-stay accommodation provided in a residential dwelling like Airbnb)

- certain Māori land

- emergency, transitional, social and council housing

- care facilities, retirement villages and rest homes

- employee accommodation

- student accommodation

- land outside of New Zealand

There is also an exemption for companies where less than 50% of their rental portfolio makes up residential property, with the majority being commercial rentals.

There’s also an exemption for property development and new builds, which we discuss in more detail below.

For a complete list of these exemptions, have a look at this info sheet.

Will You Be Able to Deduct the Interest Later?

Yes, but…

Any interest that you’re not able to deduct in the coming years can be deducted when you sell the property. However, this is only if the profit on the sale is taxable (see bright-line rules below) and the deduction may be limited to the gain.

If you don’t need to pay tax on the sale, you will lose the interest deduction.

2. Exemptions for New Builds & Property Development

New builds and property development will be exempt from the law changes, in other words, you will still be able to deduct interest you paid from your rental income.

Property Development Exemption

There is an exemption available for property development:

- Land business exemption: This applies if you hold land to develop, subdividing land, and land-dealing transactions.

- Development exemption: This applies while you’re developing property.

The second exemption applies from the time you’re starting to develop the property until you either sell it or receive the code compliance certificate (CCC). After you receive the CCC, the property becomes a new build, and the next exemption will apply.

New Build Exemption

This exemption applies to any self-contained residential properties that received their CCC on or after 27 March 2020.

The property will be classified as a ‘new build’ for 20 years from the date it received its CCC, and the exemption includes the initial owner as well as any subsequent owners in the 20-year period.

It’s also good to hear that this rule includes prefabricated, modular, and relocated homes. Additionally, it also includes the conversion of existing houses into multiple dwellings, as well as commercial buildings that are converted into residential housing.

For more details about the property development and new build exemptions, have a look at this info sheet.

3. Changes to the Bright-Line Property Rules

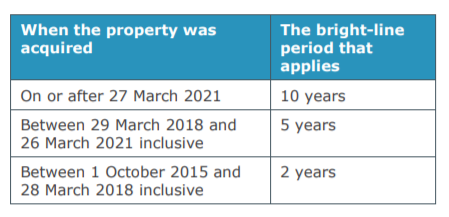

The sale of property is mostly non-taxable since we do not have capital gains tax in New Zealand. However, if you sell property within a certain period, you may have to pay income tax on the gain you make. This is not new, as it was first introduced in 2015. However, this period has now been extended from 5 to 10 years.

The rules are a bit different for new builds purchased after 27 March 2021:

- The period will only be 5 years

- You must buy the property within 12 months after it received the code compliance certificate (CCC)

- It must still have a CCC by the time you sell the property

You can find more details about the bright-line property rules here.

Where to from Now?

As you can see, these rules can become complex and may be difficult to apply. There are lots of subtle nuances that you may not know about if you’re trying to figure it out for yourself. The notes above are guidelines and cover only the most important points. It cannot be relied on as final advice.

Rather, come chat to us to help you analyse your unique situation and to make sure that you are treating your transactions correctly for tax purposes.